Photorealistic view from behind a trader’s shoulder in a dimly lit home office in the US, staring at multiple glowing monitors filled with erratic green and red candlestick charts, an old-school coffee mug spilling slightly on the desk, and faint holiday lights twinkling in the background window. Style: slightly blurred photorealistic with neon glow edges. Incorporate quirky glitch effects on one screen and a half-eaten pizza box nearby. Emotional tone: cautiously optimistic with a hint of exhaustion. Color palette: deep midnight blues contrasted with electric cyan and magenta accents.

Best crypto trading strategies have been my obsession lately, seriously, sitting here in my messy apartment in Chicago—it’s January 2026, snow piling up outside my window, and I’m nursing a cold coffee while staring at charts again. Like, I’ve been in this game for years now, and let me tell you, the best crypto trading strategies aren’t some secret sauce from Wall Street pros; they’re the ones that profitable traders grind through after getting wrecked a few times. Me? I’ve lost sleep, money, and yeah, even a relationship over bad trades—embarrassing story: back in the 2024 dip, I FOMO’d into some altcoin hype and watched 20k vanish overnight. Felt like punching my monitor. But anyway, that’s how I learned what actually works for regular folks like us in the US, dodging taxes and volatility.

Why Most Best Crypto Trading Strategies Fail for Newbies Like I Was

Look, when I started, I thought the best crypto trading strategies were all about fancy indicators and bots. Wrong. I blew my first account day trading everything that moved—chasing pumps on Twitter (sorry, X) at 3am, heart racing, thinking I was gonna retire. Nope. Profitable traders? They treat this like a job, not a casino. Raw honesty: crypto’s volatile as hell, and 90% of retail traders lose money because emotions kick in. I’ve been there, revenge trading after a loss, doubling down like an idiot. Now? I stick to rules, or I don’t trade. Check out this Investopedia piece on managing volatility—it saved my ass more than once.

My Biggest Mistake with Day Trading in Best Crypto Trading Strategies

Day trading is one of those best crypto trading strategies that sounds dope—quick flips, no overnight risk. But man, it’s brutal. I tried scalping Bitcoin during high volatility sessions, aiming for tiny 0.5% gains multiple times a day. Worked sometimes, like when BTC pumped last year, but fees ate me alive on exchanges. And the stress? I’d be glued to my screens, missing family stuff, only to get wrecked by a fakeout. Profitable traders who day trade use strict risk management—never more than 1% per trade. Me now? I mix it with swing holds. Here’s a solid guide on scalping risks from CMC Markets.

The Best Crypto Trading Strategies I’ve Stuck With: Swing Trading and Technicals

Swing trading has been my go-to among the best crypto trading strategies. You catch multi-day moves, less screen time—perfect for my lazy ass. I look for RSI divergences, MACD crossovers, moving averages on daily charts. Like, last month, ETH was oversold, I swung in, rode it up 30%. Felt genius. But contradictions: sometimes I hold too long, greedy. Profitable traders cut winners too? Nah, they let ’em run with trailing stops. I learned that the hard way. Binance Academy has killer breakdowns on these indicators.

How Dollar Cost Averaging Saved Me in Bear Markets

Dollar cost averaging (DCA) is hands-down one of the best crypto trading strategies for chill folks. I set weekly buys into BTC and ETH, no matter the price. Ignored the 2025 dips when everyone panicked—bought low automatically. No FOMO, no timing the bottom (impossible, btw). It’s boring, but profitable traders love it for long-term. My portfolio’s up solid since I started this in 2022. Embarrassing admit: I used to mock DCA as “weak,” now it’s 70% of my plan. BitPay’s blog explains it perfectly with visuals.

:max_bytes(150000):strip_icc()/Dollar-Cost-Averaging-DCA-f79fcd89eaa34bb7adad3dacc3129798.png)

Risk Management: The Real Secret Behind Profitable Crypto Trading Strategies

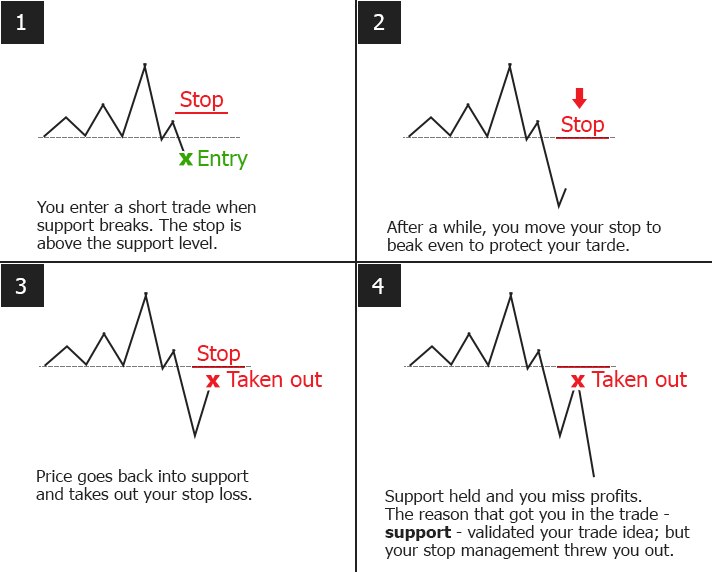

This is where I contradict everything flashy online—the best crypto trading strategies all boil down to not blowing up. I risk 1-2% max per trade, always set stop losses, aim for 2:1 reward-risk. Sounds basic, but I ignored it early and paid. Now? Even in wins, I take partial profits. Profitable traders journal every trade—I do too, scribbled notes on mistakes. Tradeciety’s reward-risk guide changed my game.

HODLing: The Ultimate Passive Among Best Crypto Trading Strategies

HODL is underrated. Buy good projects, stake ’em, forget. I’ve held BTC since 2020 dips—massive gains now. But yeah, drawdowns suck; I panicked sold some in 2022, regret it daily. Profitable traders HODL core stuff, trade edges. CoinDesk talks real strategies from pros.

Anyway, rambling over— these are the best crypto trading strategies that turned me from reckless to consistently green. Mix ’em based on your life; I’m no guru, just a flawed dude in the US sharing what worked after failures.

Start small, paper trade first, maybe DCA into something solid today. What’s your go-to strategy? Drop it below—I read ’em all. Stay safe out there.