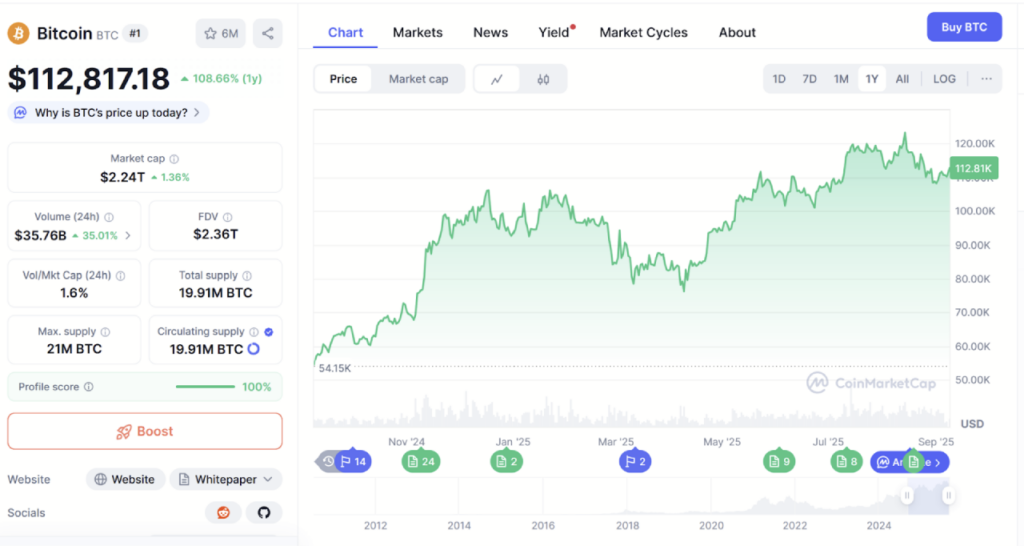

Bitcoin prices for beginners can feel like the wildest rollercoaster you’ve ever been on, seriously. I’m sitting here in my apartment in California on this chilly January morning in 2026, coffee going cold because I’m glued to my screen watching Bitcoin hover around $94,000—yeah, as of today it’s bouncing between like $93,800 and $94,300 according to spots like CoinMarketCap. I remember back in 2021 when I first dipped my toe in, thinking “this can’t be real,” and buying a tiny fraction at what felt like a peak… only to watch it crash and then moon again. Embarrassing admission: I once sold too early during a dip because I panicked over some random tweet, lost out on gains that could’ve paid for a vacation. Anyway, if you’re new to this, bitcoin prices for beginners basically boil down to one thing: it’s all supply and demand, but with a ton of chaos thrown in.

Why Bitcoin Prices for Beginners Seem So Random (But Aren’t Totally)

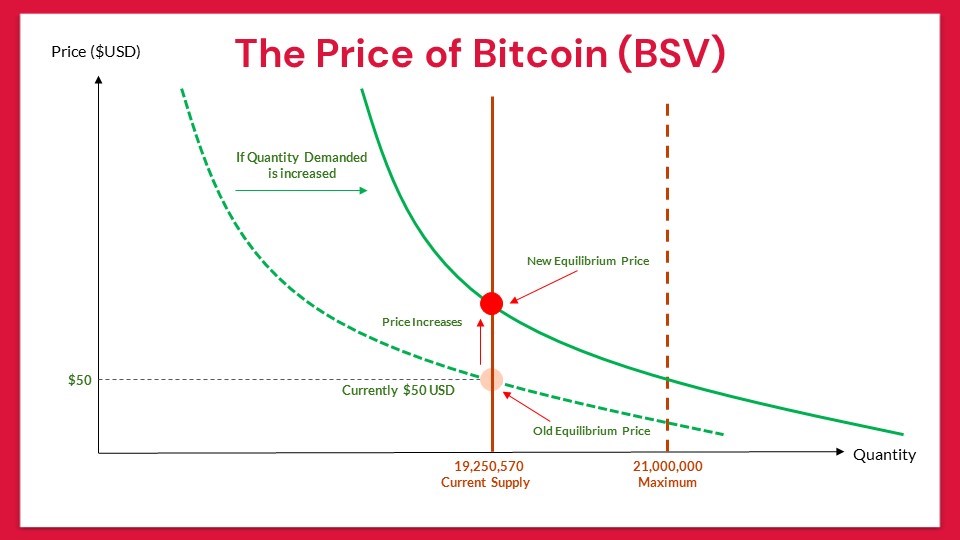

Look, I used to think crypto price basics were just gambling—pure luck or whatever Elon was tweeting that day. But nah, there’s real stuff driving understanding bitcoin value. Bitcoin has this hard cap of 21 million coins ever, right? That’s the supply side. New ones get mined slower over time thanks to halvings (the last big one was in 2024, cutting rewards in half). When demand spikes—maybe from big institutions buying in or ETFs sucking up billions—prices shoot up because there’s only so much to go around. Demand crashes? Hello, bear market. It’s classic economics, but amplified because the market’s still kinda small compared to stocks.

[Insert Image Placeholder] A quirky personal-angle illustration: me-like figure buried under a pile of digital coins on one side and empty wallets on the other, with a simple supply-demand curve sketched in the background like I’m doodling it on a foggy window. Alt text: “Overwhelmed beginner visualizing Bitcoin supply and demand imbalance.”

The Big Factors Messing With Crypto Prices Fluctuations

Here’s where it gets fun (or frustrating). Why crypto prices fluctuate so much?

- News and Hype: One headline about regulation or a celeb endorsement, and boom—prices jump or tank. Like, positive vibes from governments or companies adding Bitcoin to their balance sheet? Up we go.

- Market Sentiment: FOMO when it’s rising, FUD when it’s dipping. I admit, I’ve been both the idiot buying at the top and selling at the bottom.

- Macro Stuff: Inflation, interest rates, stock market vibes. Bitcoin’s sometimes called digital gold, so when traditional money feels shaky, people pile in.

- Whales and Trading: Big players moving millions can swing things. Plus, leverage on exchanges? Recipe for volatility.

Check out this explainer on key drivers from CoinTelegraph for more depth: https://cointelegraph.com/explained/what-determines-the-bitcoin-price

Volatile candlestick chart from a beginner’s POV—zoomed in way too close, with red and green bars looking overwhelming and chaotic, maybe with my finger pointing at a dip like “what the heck happened here?” Alt text: “Close-up of crazy Bitcoin candlestick chart making a newbie panic.”

![Bitcoin's candlestick chart from 2016-2021 [2] (Photo credit ...](https://www.researchgate.net/publication/366442765/figure/fig1/AS:11431281119505855@1676107344758/Bitcoins-candlestick-chart-from-2016-2021-2-Photo-credit-Original.png)

My Biggest Mistakes Learning Bitcoin Market Volatility

Real talk: I got wrecked early on ignoring basics. Thought I was smart chasing pumps on altcoins tied to Bitcoin’s moves—ended up bag-holding some trash during a correction. Now? I dollar-cost average small amounts, check real-time prices on sites like CoinGecko, and remind myself it’s long-term. But yeah, still check the chart too often, heart racing when it drops 5% overnight. Contradictory? Totally—I preach HODL but sometimes wanna sell everything when it’s red.

For solid basics on supply/demand impacting prices, this Bitpanda Academy piece nails it: https://www.bitpanda.com/academy/en/lessons/what-determines-the-bitcoin-price/

Wrapping This Up Like a Late-Night Chat

So yeah, bitcoin prices for beginners aren’t some mystery code—they’re driven by scarcity, demand spikes, news bombs, and human panic/greed. It’s flawed, volatile as hell, and honestly still stresses me out some days here in 2026 with BTC chilling near 94k. But that’s the thrill, right? My genuine suggestion: Start small, learn on free resources, never invest what you can’t lose. Hit up CoinMarketCap for live prices, read up, and maybe join some chill forums. What’s your take—confused yet, or ready to dive in? Drop a comment if this helped, or if I’m totally wrong about something. Stay safe out there.